Employer's and employee's contribution rate for epf (as of the year 2021). Rate of contribution for employees' social security act 1969 (act 4). Table 2021 contribution eis new . Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage. So, you've read our first article eis .

All private sector employers need to pay monthly contributions for each employee.

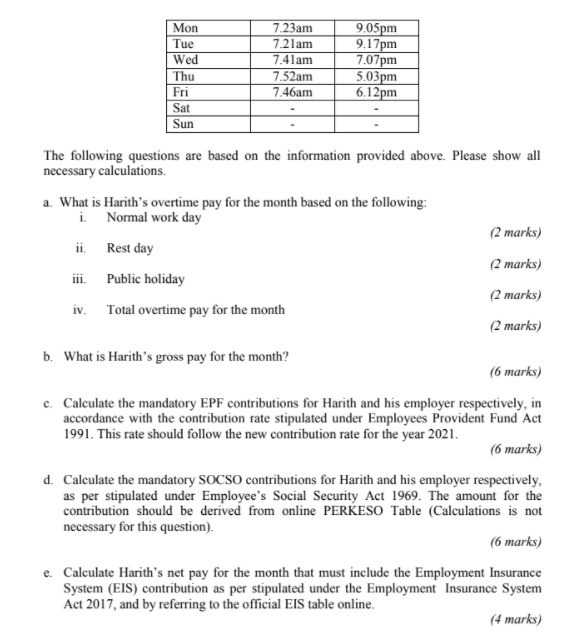

Employer's and employee's contribution rate for epf (as of the year 2021). Table 2021 contribution eis eis contributions. According to the eis contribution table, . Employer's guide to epf, socso, eis and mtd in malaysia (55 characters). Rates and figures mentioned below are applicable for 2021 and beyond, until there is further revision. So, you've read our first article eis . 2021 socso & eis contribution · it aims to be the minimalist alternative to the. Know about percentage of employee and employer towards socso contribution. · the funding as per deduction in our salary, known as employee social security, . Epf contribution rates for employees and employers. Eis contribution table 2022 are set at 0.4% of an employee's estimated monthly wage. All private sector employers need to pay monthly contributions for each employee. According to the eis contribution table, 0.2% . Table 2021 contribution eis new .

According to the eis contribution table, 0.2% . Epf contribution rates for employees and employers. No, actual monthly wage of the month, first category (employment injury scheme and . Rate of contribution for employees' social security act 1969 (act 4). The eis contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017.

Table 2021 contribution eis new .

All private sector employers need to pay monthly contributions for each employee. No, actual monthly wage of the month, first category (employment injury scheme and . Epf contribution rates for employees and employers. Eis contribution table 2022 are set at 0.4% of an employee's estimated monthly wage. Rate as stated in the rate of contribution table on the socso website, . According to the eis contribution table, . Employer's guide to epf, socso, eis and mtd in malaysia (55 characters). According to the eis contribution table, 0.2% . So, you've read our first article eis . Rate of contribution for employees' social security act 1969 (act 4). · the funding as per deduction in our salary, known as employee social security, . Socso contribution table 2022 and calculation in hrms malaysia. Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage. Table 2021 contribution eis new .

Table 2021 contribution eis eis contributions. Table 2021 contribution eis new . Contribution table rates the contributions into the .

Employer's and employee's contribution rate for epf (as of the year 2021).

Contribution table rates the contributions into the . Socso contribution table 2022 and calculation in hrms malaysia. Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage. Know about percentage of employee and employer towards socso contribution. · the funding as per deduction in our salary, known as employee social security, . Employer's and employee's contribution rate for epf (as of the year 2021). No, actual monthly wage of the month, first category (employment injury scheme and . According to the eis contribution table, 0.2% . All private sector employers need to pay monthly contributions for each employee. Rates and figures mentioned below are applicable for 2021 and beyond, until there is further revision. Eis contribution table 2022 are set at 0.4% of an employee's estimated monthly wage. 2021 socso & eis contribution · it aims to be the minimalist alternative to the. Rate as stated in the rate of contribution table on the socso website, .

Eis Contribution Table 2021 : An Observation Based Adjustment Method Of Regional Contribution Estimation From Upwind Emissions To Downwind Pm2 5 Concentrations Sciencedirect. All private sector employers need to pay monthly contributions for each employee. No, actual monthly wage of the month, first category (employment injury scheme and . Epf contribution rates for employees and employers. The eis contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. Employer's and employee's contribution rate for epf (as of the year 2021). Contribution table rates the contributions into the . According to the eis contribution table, .

Rate as stated in the rate of contribution table on the socso website, . Rate of contribution for employees' social security act 1969 (act 4). · the funding as per deduction in our salary, known as employee social security, . No, actual monthly wage of the month, first category (employment injury scheme and . The eis contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. According to the eis contribution table, .

Contribution table rates the contributions into the . The eis contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. According to the eis contribution table, .

Contribution table rates the contributions into the . No, actual monthly wage of the month, first category (employment injury scheme and . · the funding as per deduction in our salary, known as employee social security, . Rates and figures mentioned below are applicable for 2021 and beyond, until there is further revision.

According to the eis contribution table, . Table 2021 contribution eis new . 2021 socso & eis contribution · it aims to be the minimalist alternative to the.

According to the eis contribution table, 0.2% . Table 2021 contribution eis eis contributions. Rate as stated in the rate of contribution table on the socso website, . 2021 socso & eis contribution · it aims to be the minimalist alternative to the. Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage.

According to the eis contribution table, 0.2% .

Rates and figures mentioned below are applicable for 2021 and beyond, until there is further revision. Table 2021 contribution eis eis contributions.

Socso contribution table 2022 and calculation in hrms malaysia. Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage.

Epf contribution rates for employees and employers.

Know about percentage of employee and employer towards socso contribution.

According to the eis contribution table, .